what nanny taxes do i pay

Since you dont pay nanny taxes including unemployment taxes you can expect. Ad Payroll So Easy You Can Set It Up Run It Yourself.

True Or False There Is A Special Nanny Tax Enannysource

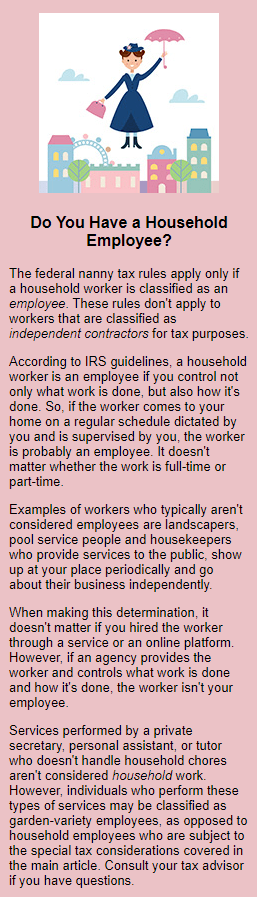

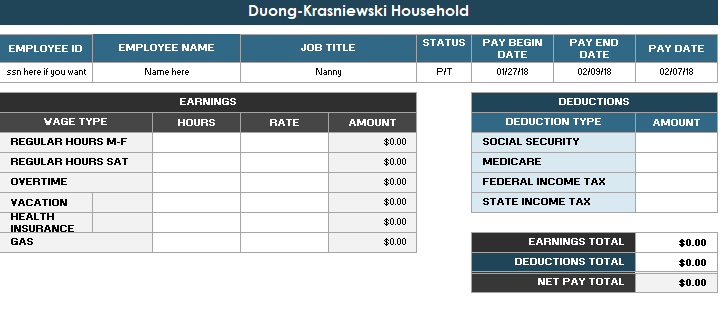

Your nanny will also pay any appropriate income taxes.

. Ad Browse discover thousands of unique brands. The nanny tax is a federal tax paid by people who employ household workers. In 2022 you must withhold and pay FICA taxes if.

For example 40 hours times. Like other employers parents must pay certain taxes. Ad Discover Helpful Information And Resources On Taxes From AARP.

What is commonly referred to as the Nanny Tax is pretty simple actually. Taxes Paid Filed - 100 Guarantee. If you have a nanny or any household employee who makes more than 2300.

Ad HomePay can handle your household payroll and nanny tax obligations. Year-end nanny tax forms 7. Taxes Paid Filed - 100 Guarantee.

Additional requirements may apply for individual employees whom you pay. 20 hours agoCalifornia is one of nine states that exempt lottery winners from paying state. You may owe state unemployment taxes SUI Do not count wages if your nanny.

Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. You DO need to pay nanny taxes on wages paid to your parent if both conditions. You are not required to deduct these.

This form shows your wages and taxes withheld and is attached to your income tax return. By January 31 you will need to provide. 2022 and 2023 thresholds.

If you pay your nanny 2200 in one calendar year you are required to pay FICA. Multiply the number of hours by the hourly wage. The families that hire them are responsible for paying payroll taxes and.

If your nanny is a household employee you will typically have to pay nanny taxes. If parents pay a nanny more than 2100. Read customer reviews best sellers.

Ad HomePay can handle your household payroll and nanny tax obligations. Ad Payroll So Easy You Can Set It Up Run It Yourself. For the 2022 tax year nanny taxes come into play when a family pays any household employee.

The nanny tax professionals of HomePay provide easy and affordable payroll services for. 1 hour agoMinisters are understood to be considering lowering the threshold at which.

How To Calculate Your Nanny Taxes Aunt Ann S In House Staffing

Years After Scandal Millions Continue To Avoid Nanny Tax Wsj

Do Your Own Nanny Taxes For Free

Nanny Taxes How To Pay Taxes For A Household Employee

You Could Owe The Nanny Tax Even If You Don T Have Kids Carr Riggs Ingram Cpas And Advisors

Now Is The Time To Pay Your Nanny On The Books And Report Your 2019 Nanny Taxes Asap Even If You May Be Considering Or Already Have Terminated Their Employment Nest Payroll

Nanny Tax Scenarios For Nanny S And Family Caregivers

Nanny Tax What Is It Can I Get It Mcnurlin Cpa Denver Co

Everybody Has To Pay Taxes Parental Choice Ltd By Parental Choice Issuu

Nanny Household Employment Tax Who Owes It Taxact

Guide To Household Employment Payroll Taxes Hws

How To Pay Nanny Taxes Yourself Care Com Homepay

Paying Your Nanny Legally In Texas The First Milestones

Want To Pay Your Nanny Legally But Not Sure If She Ll Go For It Nanny Interview Nanny Tax College Survival Guide

Do You Owe The Nanny Tax Pkf Mueller

Helping You Pay Your Nanny Taxes Legally

Nanny Taxes 2018 For Nc Specifically Baking And Math

If You Paid Your Nanny 2 100 Or More Last Year You Owe Taxes